- Returns from wine often outpace art and other alternative investments, while being less volatile than stocks.

- Nick King, CEO and co-founder of fine wine investing platform Vint told Insider why you should add it to your portfolio.

- Vint’s head of wine Billy Galanko layed out the wine regions which are the top investments right now.

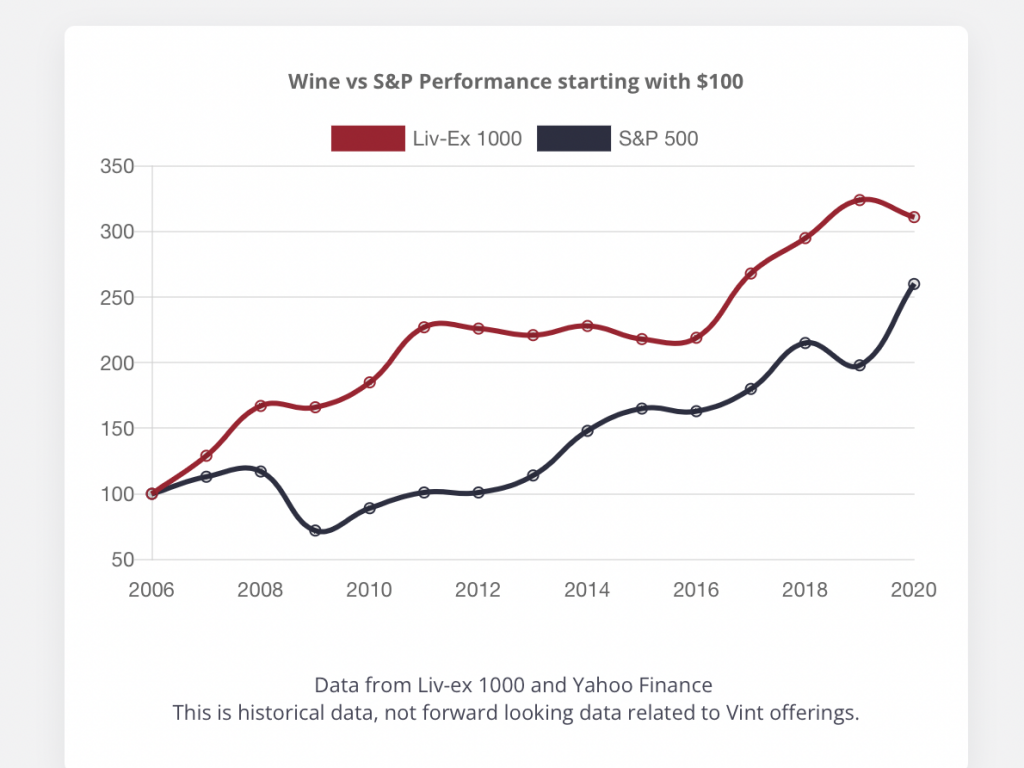

When crisis strikes the global economy, fine wine has come to investors’ rescue in the past. During the 2008 financial crisis, the main index for wine investing the Liv-Ex 1000, actually went up while the stock market slumped.

In fact, returns from wine have often outpaced art and other alternative investments, while being less volatile than the stock market, and uncorrelated.

This combination of stability and profitability makes wine “the ultimate portfolio diversification asset” according to Nick King, CEO and co-founder of wine investing platform Vint.

King, who has a background in the equities investment industry, said wine delivers reliable returns over the long term, but has traditionally been hard to access for the average investor.

“We didn’t think it was a good product experience to send someone $25,000 and you would get a list of wines three weeks later. We thought it was exclusive, opaque and efficient. So we spent eight months with the SEC to get qualified.”

“That allows us to curate these collections of fine wines and spirits, file the paperwork with the SEC and then allow both accredited and non-accredited investors to buy shares in these collections.”

The Liv-Ex 1000 has returned nearly 24% to investors over the last 12 months, compared with 8% from the S&P 500, for example, and 5% in the year to date, versus an 11% drop in the blue-chip stock index.

King explained that each Vint collection is its own LLC issuing shares, which is a “very efficient and trusted” investment structure that essentially allows investors to buy fine wine exposure in a similar way to picking up stocks. All the logistical challenges and costs related to acquiring and storing bottles are taken out of the equation by the model.

“From an efficiency perspective, similar to equities, people want to be diversified across the wine spirits industry and they also want to be participating in the the top end of this industry. So with this fractional nature, you can get that.”

“Wine can be that stabilizer in your portfolio,” King continued. “But it also has this long track record of 8.5% annual returns over the last 121 years. I kind of look at it through the lens of modern portfolio theory. It’s not going to hurt your returns, and it’s actually going to help your risk adjusted returns.”

In terms of which wines to invest in once you have decided to allocate some cash, there are certainly some particular regions and vintages that investors should be focusing on.

Vint’s head of wine Billy Galanko said the first thing you need to do is make sure you have a good proportion of the “blue chips” in your in your portfolio – the most highly regarded and established categories of fine wine. These are the famous European wine regions such as Bordeaux and Burgundy.

“You want to have some of those that are having momentum and then keep an eye on some of the really emerging stuff too, like South American regions and here in the United States as well. I think having this diversified side is important, not only regions but vintages as well,” Galanko said.

Galanko said smart wine investors will keep an eye open for emerging trends or crazes, and try and tap in early on.

“An example is the Bordeaux craze driven by the Asian market in the early or late 2000s, early 2010s. They started piling money in in 2009, you would have thought Bordeaux couldn’t go up anymore but it kept going up in 2010 and 2011.”

“Right now we are seeing Champagne has had an amazing year last year and then Burgundy as well. They are the ones people are really getting into right now.

He added that when people have piled into to very best of wines, investors can do well by buying into the “second wines” of the top producers. “Those are getting some runway, and they’re kind of having this halo effective across their broader region.”

“We’ve seen Napa Valley have an amazing year last year and I don’t know if that’s just purely because of the collectability and the cult likes status of a lot of these wines,” Galenko added. “They’re just being really introduced to the UK and Europe on a broader scale.”

“So I would say focus on those right now, and we still have our fingers in wine from Spain and the Rhone Valley, which I think have a bit more runway to go too.”